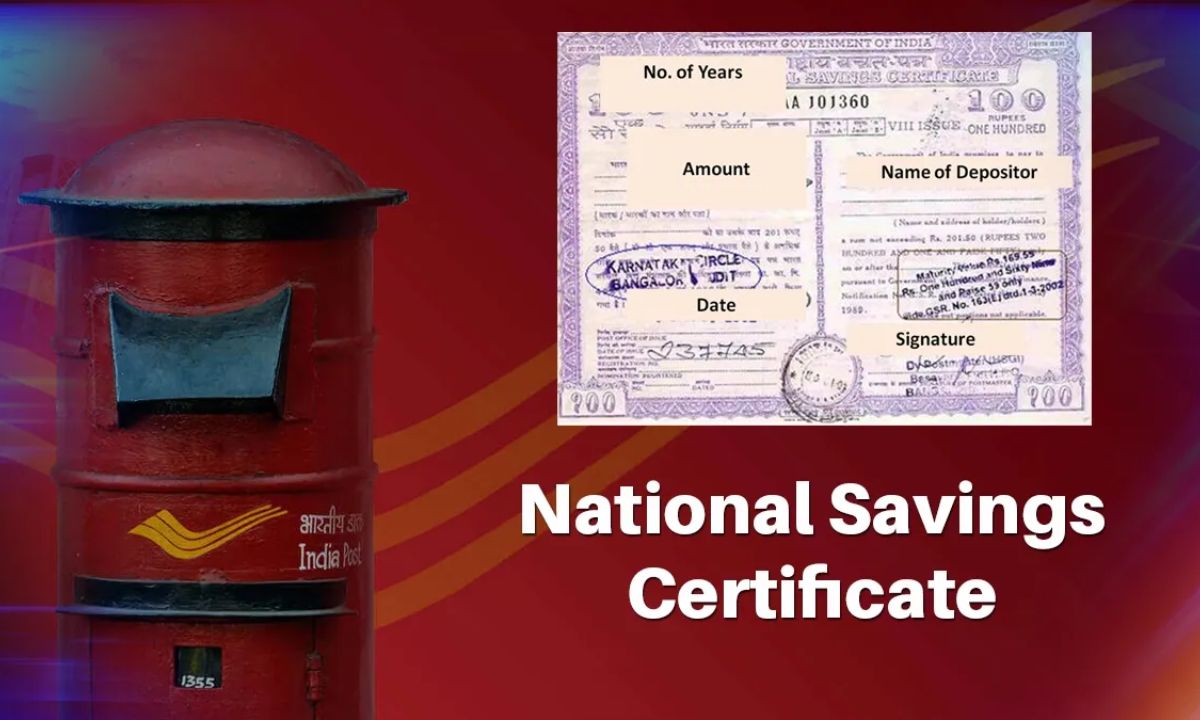

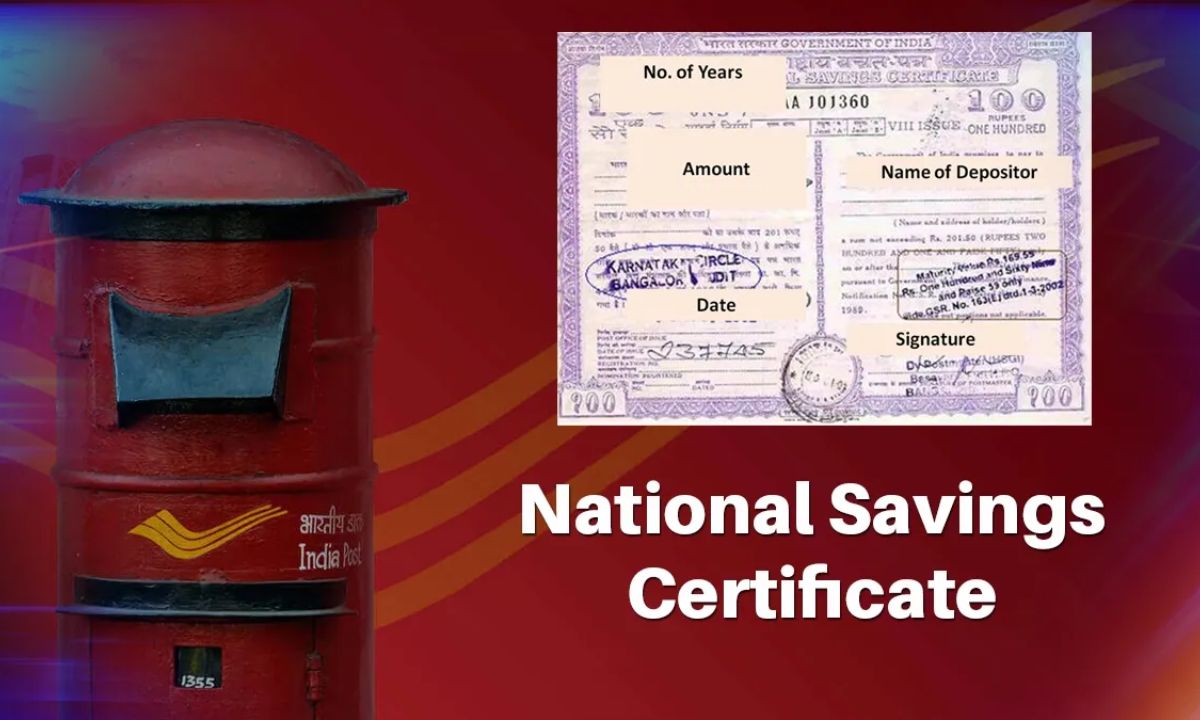

NSC Scheme: If you want to invest your savings in a safe and profitable way, the post office savings schemes can be a great option. Through these schemes, you can not only keep your money safe, but can also enjoy good returns. One of them is the best scheme, National Savings Certificate (NSC Scheme). If you are wondering how to invest in this scheme and what will benefit it, then let us know.

What is NSC and why is it special?

The National Savings Certificate (NSC) is a government scheme that gives you good returns on your investment with great interest rate. If you want to invest in a post office scheme, NSC can prove to be an excellent and reliable option. In this, your money keeps increasing according to the interest rate fixed by the government.

Great interest and calculation of 7.7%

You get 7.7% compound interest on investing in NSC. This means that your money increases with time. For example, if you invest Rs 1,000, you will get interest on it next year. In this way your investment will continue to grow every year. In this scheme, interest is given to you after 5 years and you get the government guarantee for it. Meaning, your money safety is completely sure.

The benefit of tax exemption also

If you want to increase your tax savings, the National Saving Certificate is another great way for you. Under Section 80C, you get income tax exemption on investment made in NSC. This means that you can save tax of up to Rs 1.5 lakh in a year. After investing in this scheme, you get rid of tax, which increases your total savings.

Lock-in period: Is it benefit?

The NSC has a 5-year lock-in period, which means that you have to maintain your investment for 5 years. Initially it may seem a bit difficult, but when you maintain investment for a full 5 years, you get interest on the entire amount. If you try to withdraw money quickly, only the original amount is returned, interest will not be received.

This NSC Scheme is also for children

If you are also thinking for your children, then an account can also be opened in the name of children under 10 years of age. This account can be operated by their parents. This can be a great savings scheme for the future of children.

How can you earn 5 lakhs in five years?

If you want to earn 5 lakh rupees in this scheme, then you do not need to invest outright big. For example, if you invest Rs 11 lakh, you will get Rs 15,93,937 after 5 years. Your total interest will be Rs 4,93,937. Next, if you want (NSC Scheme) then you can also increase this amount.

Why invest?

NSC Scheme is an investment in which you not only get good returns, but also guarantee security. Also, in this scheme you also get tax exemption. If you are a safe, reliable and good return -looking investor, then NSC is a great option for you.

conclusion:

If you want to protect your money and also to save tax with good returns, the National Savings Certificate (NSC Scheme) can be a great option. Investing in it is not only safe, but it will also give you good returns. So, now you have a great investment opportunity.

Also read:-

Dailynews24 App:

Read the latest news of country, education, entertainment, business updates, religion, cricket, horoscope. Download daily breaking Hindi news and video short news coverage here.